The Bureau of Internal Revenue (BIR) has filed multiple criminal complaints against Pacifico “Curlee” Discaya II, Cezarah Rowena “Sarah” Cruz Discaya, and an officer of St. Gerrard Construction Gen. Contractor & Development Corporation over an estimated ₱7.18 billion in unpaid taxes.

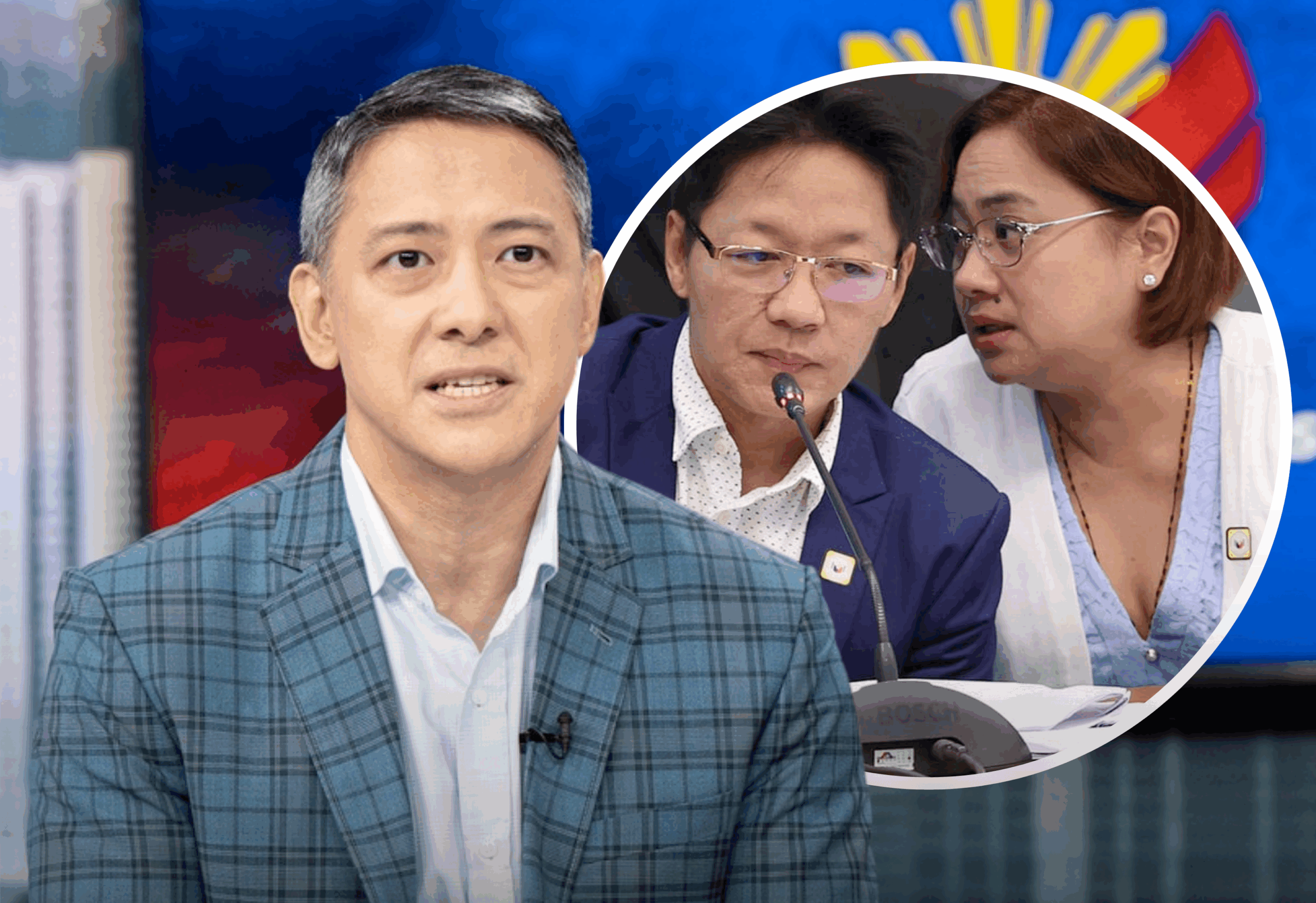

BIR Commissioner Romeo Lumagui Jr. said the charges cover the couple’s unpaid individual income taxes, excise taxes on nine luxury vehicles, and documentary stamp taxes related to their alleged divestment from four corporations.

According to Lumagui, the cases focus on the Discayas’ personal tax liabilities from 2018 to 2021 but are “only the beginning,” as ongoing audits of their companies could uncover billions more in unpaid taxes.

The BIR discovered that the couple failed to file documentary stamp tax returns and pay the required taxes for the transfer of shares in four of their companies — St. Gerrard, St. Timothy, St. Matthew, and Alpha & Omega — contradicting their earlier claim that they had divested from these firms.

Investigators also found that the couple and St. Gerrard Construction did not submit excise tax returns or pay the corresponding taxes on nine luxury vehicles registered under their names, based on records from the Land Transportation Office (LTO).

The BIR said it will continue its audit of the Discaya group of companies, adding that if more tax deficiencies are uncovered, additional tax evasion charges will be filed.